Helo visitors,

In this article, I will discuss about TRECENTO Blockchain Capital.

First I will explain about What is TRECENTO Blockchain Capital, we are a short Blockchain Capital with BC. Trecento BC is a Tracento SAS Company Group. Previous Trecento SAS has achieved recovery with Trecento Asset Management in 2011 launched by Alice Lhabouz. And this time Trecento SAS Group has started work using the Blockchain system of Trecento Blockchain Capital.

Introduction, What is Trecento Blockchain Capital?

Trecento Blockchain Capital is a team of experienced professionals in investment and technology, a comprehensive investment solution based on Blockchain.

The goal of Trecento Blockchain Capital is to attract the best investment opportunities associated with the Blockchain revolution, offering investors simplicity and reliability.

Thus, Trecento Blockchain Capital will publish 4 thematic funds covering Blockchain’s full investment cycle, as well as the goal of Trecento Blockchain Capital is to provide significant returns to investors by attracting the best business opportunities offered by Blockchain technology through its 4 investment funds.

Everything is in a safe and controlled environment.

Everything is in a safe and controlled environment.

=> Problems?

The market is growing, bouncing and full of potential returns for investors. But at the same time, it remains difficult to judge, with ongoing innovation and many projects that are either unreal (fraud), or unfeasible. Therefore this market is characterized by a high level of complexity, a strong lack of transparency and a clear regulatory framework. This makes it difficult to understand and therefore

invest.

invest.

=> Solution

Trecento Blockchain Capital has been launched by a team of experienced investment and technology professionals. The goal of Trecento Blockchain Capital is to capture the best business opportunities offered by Blockchain technology through a 360-degree investment approach. Trecento Blockchain Capital aims to provide both individual and institutional investors with a straightforward and performing investment solution that relies on our 4 investment funds. All in safe and orderly

living environment.

living environment.

=> Means and Resources

Trecento Blockchain Capital Fund Source with ICO (Initial Coin Offering) will be launched during Q2 2018 which will be used to finance the development of our infrastructure and activities, the long-term growth of Trecento Blockchain Capital and the acceleration of fundraising. The ERC-20 utility token will be issued (“Trecento Token” or “TOT”). We aim to collect € 20 million.

Token

Token Name = Trecento Token

Tipe Token = Utility Token

Supply = Capped FCBS-base, variable supply

Ticker = TOT

Algoritma = ERC20

Softcap = 5.000.000 Euro

Hardcap = 20.000.000 Euro

ICO Periode = June and September 2018

Our Products, Services & Tools

Trenceto has 4 themes in its products, namely:

1. ICO Fund: Investing in an innovative company raise funds during personal sales (upstream).

2. Crypto Trading Fund: Trade and Arbitration of cryptocurrency and digital assets.

3. Venture Capital Fund: In-equity investment startups developed an annoying Blockchain solutions.

4. Fund of Funds: Investment in special funds active in cryptocurrency.

1. ICO Fund: Investing in an innovative company raise funds during personal sales (upstream).

2. Crypto Trading Fund: Trade and Arbitration of cryptocurrency and digital assets.

3. Venture Capital Fund: In-equity investment startups developed an annoying Blockchain solutions.

4. Fund of Funds: Investment in special funds active in cryptocurrency.

About ICO

ICO PHASES AND ALLOCATION

Private Sale 30 Sept. or as soon as SoftCap reached €1 (EUR) €50,000 (EUR) 30.0%.

Pre Sale :

1–15 October €1 (EUR) €10,000 (EUR) 20.0%

15–23 October €1 (EUR) €10,000 (EUR) 17.5%

23–30 October €1 (EUR) €10,000 (EUR) 15.0%

Public Sale

1–15 November €1 (EUR) €1,000 (EUR) 8.0%

15–23 November €1 (EUR) €1,000 (EUR) 4.0%

23–30 November €1 (EUR) €1,000 (EUR) 0%

Token Allocation

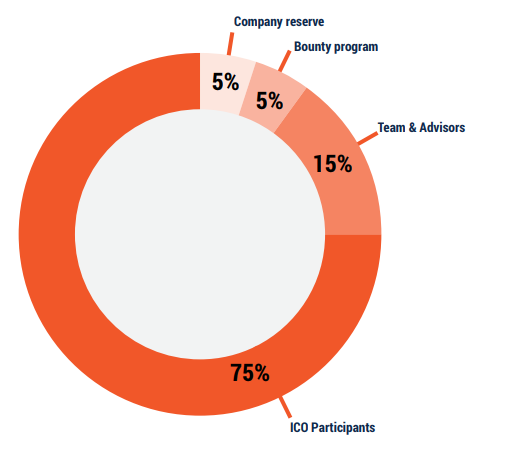

Trenceto Token Allocation :

- For ICO Participants 75%

- For Team And Advisors 15%

- For Bounty Program 5% , dan

- For Company Reserve 5%

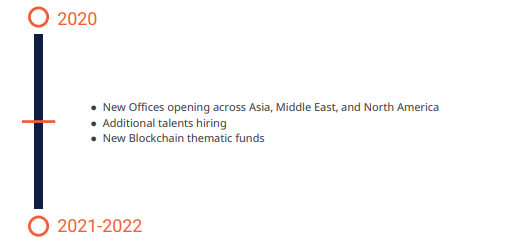

Roadmap

Team

Hubert De Vauplane as Advisor — Lawyer & Partner at Kramer-Levin (specialized in Financial and Banking law, Alternative financing, Asset Management, Digital payment

Nils Veenstra as Advisor — Co-Founder of the global Blockchain Ecosystem Network (BECON) & strategic investment and dev. of blockchain projects/IC

Christophe David As CEO — DMS INVESTMENTS — Advisor and CFO of Dombraider

Sam Fayon as Business Advisor

Matthias Poirier as Key Partner — Founder of MPG Partners, a Management Consulting firm specialized in Financial services

Germain Mathieu as Key Partner — Founder of MPG Partners, a Management Consulting firm specialized in Financial services

Partner And Providers

Website : https://ico.trecento-blockchain.capital

Bitcointalk ANN : https://bitcointalk.org/index.php?topic=4417903.msg39371324#msg39371324

Whitepaper : https://ico.trecento-blockchain.capital/wp-content/uploads/2018/05/TrecentoBC-Whitepaper.pdf

ICO Website : http://ico.trecento-blockchain.capital/

Document Bundle : https://ico.trecento-blockchain.capital/wp-content/uploads/2018/05/20180531-TBCT-DOCS.zip

Tag: ICO TrecentoBC TrecentoICO

Blockchain

ICO

Bitcoin

Ethereum

Cryptocurrency

Bitcointalk Username: adifx

Bitcointalk Profile URL: https://bitcointalk.org/index.php?action=profile;u=1502350

Telegram: Telegram url: https://t.me/soaib_hossain_sohag

ETH WALLET: 0x71123E62201060fC3155AF4E4c752AC3659DDECA

Email: soaibhossain.bdpro@gmail.com

No comments:

Post a Comment